- Igloo, one of Southeast Asia’s fastest-growing insurtech continues to deliver affordable and accessible insurance coverage in Vietnam with 3 new insurance products through its partnership with AhaMove, Vietnamese on-demand delivery platform

- 3000 drivers will receive a 60% discount on Hospital Cash Allowance insurance coverage, as part of a community initiative from Igloo and Ahamove to protect frontline workers amidst the complicated COVID-19 situation

- Drivers can choose from 3 plans starting from as low as 45,000VND/month, with hospitalisation allowance of up to 1,000,000VND/day

Ho Chi Minh City, Nov 25, 2021 – (ACN Newswire) – Igloo, Singapore-headquartered and Southeast Asia-focused insurtech strengthens its partnership with AhaMove, Vietnam’s fastest-growing delivery platform with 3 new insurance product offerings – Hospital Cash Allowance and Motor Insurance (coming soon), and Transit Insurance for over 120,000 riders and 2 million customers. These products come on the heels of AhaMove and Igloo’s Personal Accident Cover for AhaMove’s drivers launched in May this year, bringing the total of products offered to four.

In light of the complicated COVID-19 situation across the country and recognition of the challenges of its drivers, AhaMove and Igloo are committed to supporting the health and financial well-being of AhaMove’s drivers. Over the next three months, 3000 drivers who purchase Hospital Cash Allowance plans will enjoy a 60% discount.

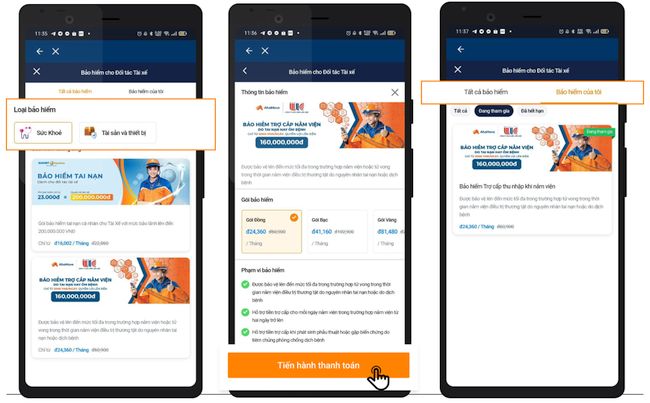

Under this insurance plan which is underwritten by UIC Insurance, drivers are entitled to an allowance for daily hospitalisation due to the impacts of the pandemic up to 50 days a year and a one-time sum insured for surgical allowance. Drivers can choose from 3 plans starting from as low as 45,000VND/month, with hospitalisation allowance of up to 1,000,000VND/day.

Nguyen Huu Tu Tri, Country Manager of Igloo in Vietnam, said “We are happy to partner with AhaMove to develop three unique products that address the current pain points experienced by AhaMove’s drivers. Goods delivery services and delivery drivers have played an essential role in our lives, especially when COVID-19 cases in Vietnam are still high. With Igloo’s speed-to-market approach, we were able to design solutions that address the current situation just within 6 months. Moving forward, Igloo will actively explore possible strategic partnerships to offer insurance protection solutions for the locals in Vietnam.”

Tran Le Hoai Bao, Head of Product, AhaMove said, “We are delighted to work with Igloo again given the successful partnership grounded on the values of ensuring both the financial and health protection of our drivers. Our drivers play an important role in the supply chain so the local citizens can continue with their daily lifestyles smoothly.”

To purchase the Hospital Cash Allowance plan, drivers just need to access their AhaMove app to choose one of three plans (Bronze, Silver, and Gold), make payment, and activate the plan. Users can change or upgrade their plan at any time with simple steps, or check the claim status within the app. To make a claim, drivers will be directed to Igloo Claim Portal for further instruction.

Earlier this year, Igloo and AhaMove launched a Personal Accident plan in Vietnam to provide insurance designed specifically for the unique risks that delivery drivers face in their daily work. The insurance plan covers drivers up to VND 200,000,000 starting from as low as 16,002VND/month.

In Vietnam, Igloo aims to embark on more partnerships and expand their team and tech capabilities to fulfill the mission of providing digitally-driven lifestyle focused products that suit the changing needs of consumers today.

Images of AhaCare are available for download here.

About Igloo

Igloo, previously known as “Axinan”, is the first full-stack insurtech firm to emerge from Singapore. It has offices in Singapore, Indonesia, Thailand, the Philippines, and Vietnam, and tech centres are located in China. With a mission of making insurance accessible for all, the firm leverages big data, real-time risk assessment, and end-to-end automated claims management to create B2B2C insurance solutions for platform companies and insurance companies. Igloo’s insurance solutions enable companies to eliminate their exposure to operational risk, create new revenue streams, and optimize and enhance existing products and services. In April 2020, Igloo successfully closed its Series A+ funding round worth US$8.2 million, bringing its total funding to US$16 million from global investors.

Igloo is led by a core team that comprises top talent from the technology and insurance industries hailing from global corporations including Facebook, Grab, Flipkart, Garena, Manulife, Shopee, Yahoo! and Zalora.For more information, please visit https://www.iglooinsure.com/

About AhaMove

AhaMove is a service that helps more than 100,000 business owners to deliver their goods within the urban areas of Hanoi and Ho Chi Minh City. The company provides a fast speed service with reasonable costs and a powerful delivery team. AhaMove also helps more than 25,000 Vietnamese drivers and drivers earn monthly income with attractive fee and bonus policy. Collaborated with GHN, AhaMove undertakes delivery services in 63 provinces and cities and a network covering up to 11,000 communes and wards across the country with high speed and stable service quality. For more information, please visit https://ahamove.com/

Media Queries

PRecious Communications for Igloo

igloo@preciouscomms.com

Pham Thi Thanh Thu, PR Specialist, AhaMove

thuptt@ahamove.com

For more information about AhaCare, please visit: https://ahamove.com/tinhnangahacare